Setting up a reliable environment is the backbone of any successful crypto automation system.

Before your bot can trade profitably, it must operate on infrastructure that guarantees uptime, low latency, and robust security. This is where RDP comes in. An RDP server creates the ideal foundation for deploying trading bots by offering 24/7 access, full control, and isolation from local machine failures or bandwidth issues.

Trading bots have transformed how traders engage with the market, automating decisions, reducing emotional mistakes, and allowing consistent execution of strategies around the clock. However, real profits depend on more than automation alone. From strategy design to infrastructure, every layer matters.

If you are serious about using crypto as a consistent income engine, it’s critical to understand the broader ways to make money with bitcoin, not just through bots. Choosing to buy RDP with Bitcoin is a smart move; it enhances both operational privacy and financial discretion while ensuring that your trading system runs with maximum efficiency.

This article walks you through the essential steps of setting up trading bots in a secure RDP environment, from beginner-friendly strategies to advanced implementation techniques, so you can deploy your bot confidently and trade with precision.

1. Choose a Trading Platform or Exchange

When setting up trading bots for crypto trading, choosing the right platform or exchange is essential. The platform should provide a stable and secure environment for automated trading. Look for platforms with strong API support to seamlessly integrate your trading bot.

Platform APIs, fee structures, and execution speed are only part of the equation. The real edge often lies in how the best bitcoin & crypto trading bots handle logic, filtering signals, managing risk, and adapting in real time.

Security features like two-factor authentication (2FA) and encryption are crucial, especially when you are using a Bitcoin trading bot or hosting on an RDP server.

For beginners, consider platforms with user-friendly interfaces and educational resources. More advanced users may prioritize platforms with powerful charting tools, real-time data, and the ability to automate complex strategies.

Pay attention to fees: some platforms charge trading commissions or withdrawal fees, which can add up over time. Always choose a platform that matches your trading strategy, whether it is day trading or long-term holding. When you buy RDP with Bitcoin, ensure the exchange supports your preferred payment method and provides quick withdrawal options.

When deciding on a platform for your crypto trading bot, comparing features and performance through reviews like 3Commas vs. Cryptohopper helps to find the best crypto trading bot platform.

By selecting the right trading platform, you ensure that your crypto trading bot operates smoothly, making decisions based on real-time market conditions.

2. Buy an RDP Server for Trading Bot Hosting

When setting up trading bots, hosting them on an RDP server is essential for ensuring high stability and performance. RDP servers offer uninterrupted access to your bots, making sure they run 24/7 without downtime, which is critical when executing time-sensitive strategies.

The security features of RDP, such as encrypted connections and secure authentication, ensure that your trading bot remains safe from potential threats, protecting both your assets and strategies. Additionally, RDP servers allow you to access and manage your bots remotely from anywhere, giving you full control over your setup.

Moreover, buying RDP with Bitcoin not only enhances your privacy but also adds a layer of discretion to your transactions, ensuring your financial actions are secure. Read more to explore how choosing to buy RDP with Bitcoin can provide significant security benefits and convenience in setting up your trading bots effectively.

This powerful combination of stability, security, and control makes RDP the ideal environment for setting up trading bots, particularly when trading in the fast-paced world of crypto.

3. Define Your Trading Strategy

Before setting up trading bots, your strategy isn’t just the first step; it’s the blueprint that governs every trade your algorithm will make.

The foundation of setting up trading bots lies in designing a clear, rule-based strategy that aligns with your objectives, risk tolerance, and market behavior. This strategic framework determines how the bot interprets data, when it enters or exits trades, and how it allocates capital, making it the most critical step before any RDP deployment or coding begins.

Effective trading strategies often draw from a range of disciplines. Technical analysis relies on indicators such as moving averages, RSI, and support/resistance levels to detect price patterns. Statistical strategies may incorporate volatility models, mean reversion logic, or regression-based predictions.

More advanced implementations include market microstructure analysis, such as order book dynamics or latency arbitrage, which require real-time precision and a deep understanding of execution layers. In some cases, macroeconomic indicators or even fundamental data may be used to enhance directional bias.

Mastering automated crypto trading strategies like those used in algorithmic systems can significantly enhance the efficiency and consistency of your trading bot setup.

When considering how to set up trading bots, it’s essential to ensure your chosen methodology is both programmable and backtestable. The logic must translate into a set of conditions that the bot can execute autonomously on the RDP environment, without manual intervention.

A well-defined strategy not only improves consistency but also reduces emotional bias and operational risk over time.

As you refine your trading strategy, exploring comprehensive guides like How to Choose the Right Crypto Trading Bot Strategy can offer valuable insights into selecting the optimal approach to ensure your bot works seamlessly with your plan.

How does Strategy help in automating Buy and Sell Decisions?

Once you have defined your strategy, the bot takes over, executing trades based on the rules you’ve set. For example, it might be programmed to buy when the price drops 18% below the moving average, and sell when it rises 25%.

This removes human emotion from trading, ensuring consistent, rule-based execution. The strategy you choose directly shapes how well the bot performs in the market. Clear, precise rules lead to smoother, more effective trades.

4. Choose a Programming Language and Framework

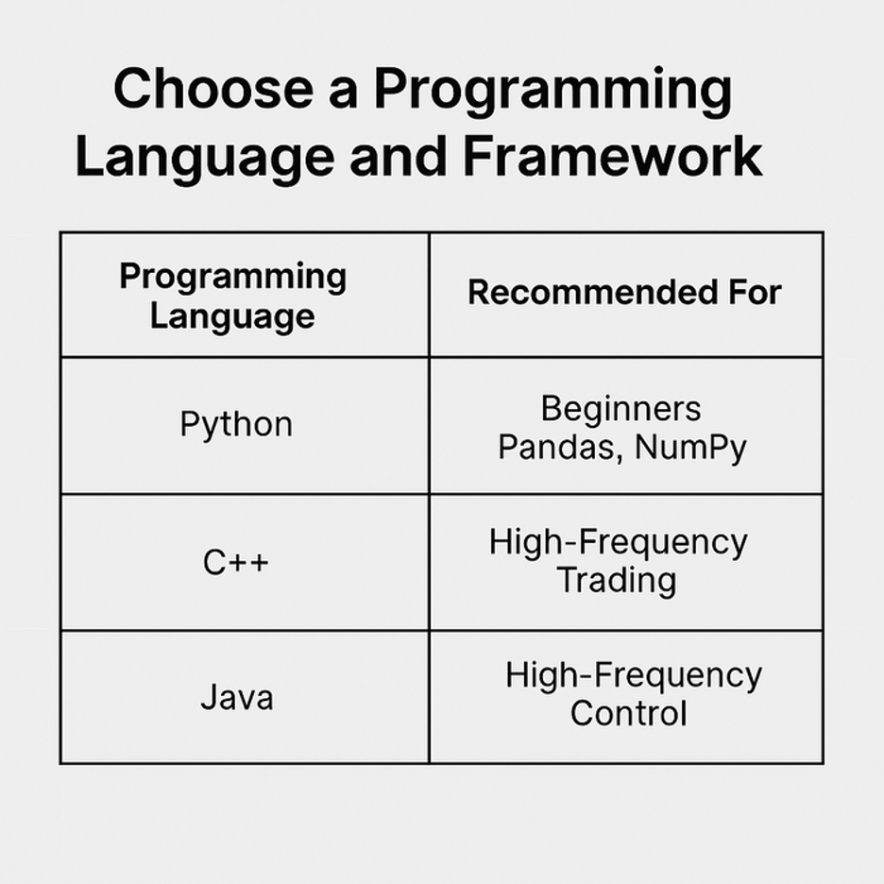

When choosing a programming language for setting up trading bots, it’s important to prioritize factors like speed, reliability, and ease of implementation based on your specific strategy.

Python is often recommended for beginners due to its simplicity and strong ecosystem of libraries like Pandas and NumPy, which are ideal for handling financial data. For high-frequency traders, languages like C++ or Java may be preferable for their faster execution speeds and more control over memory and performance.

Each language has trade-offs. While Python offers ease of use, languages like C++ provide better performance, making them more suitable for high-speed environments. Additionally, you should also evaluate the available frameworks and the community support for each language.

For crypto trading bots, understanding the architecture and selecting a language that aligns with your specific requirements will ensure the success of your automated trading system.

5. Connect the Bot to the Exchange via API

Connecting your crypto trading bot to the exchange via an API is a crucial step in setting up trading bots. Most exchanges offer well-documented APIs that allow you to access market data, execute trades, and manage your account programmatically.

You will need API keys, which should be stored securely, especially when working in an RDP environment. Make sure to configure your API access with the appropriate permissions, such as trading and withdrawal limits, to protect your funds.

By securely linking your trading bot to the exchange, you ensure seamless operation within your automated strategy and can focus on refining your approach without manual intervention.

6. Backtest Your Trading Bot

Before live deployment, a bitcoin trading bot must be tested against historical data. Backtesting shows how your logic behaves in real conditions, across spikes, slumps, and sideways drift. It’s not a one-time task. Every time you modify trade logic, indicators, or timeframes, you run a new test.

Use one slice to build, and the other to validate, to split your dataset. Watch for key metrics, drawdown, exposure time,and profit-to-loss ratio. A system that looks good in charts doesn’t always survive the chaos of live markets.

In setting up trading bots inside an RDP environment, especially when running RDP with Bitcoin, reliable backtesting ensures your trading bots aren’t just running—they’re making decisions with edge and precision.

7. Set Up Security Measures on RDP

Securing your bitcoin trading bot is non-negotiable, especially when setting up trading bots in a live environment. The risks are significant, malicious actors can exploit vulnerabilities, gaining access to your assets or manipulating your trades.

Security in the world of cryptocurrency goes far beyond firewalls, especially when using trading bots that interact with exchanges and store private credentials. Protecting these systems is critical to maintaining the integrity of your automated trading operations.

This is particularly true if you buy RDP with Bitcoin, as it ties your trading actions directly to financial transactions. The consequences of a security breach are far-reaching, from financial losses to compromised sensitive data.

To mitigate this, ensure strong security measures:

Implement encrypted connections.

Use multi-factor authentication.

Regularly monitor for any suspicious activity.

By establishing clear response protocols and consistently monitoring your RDP setup, you can protect your automated trading environment from threats, keeping your bot running smoothly and securely.

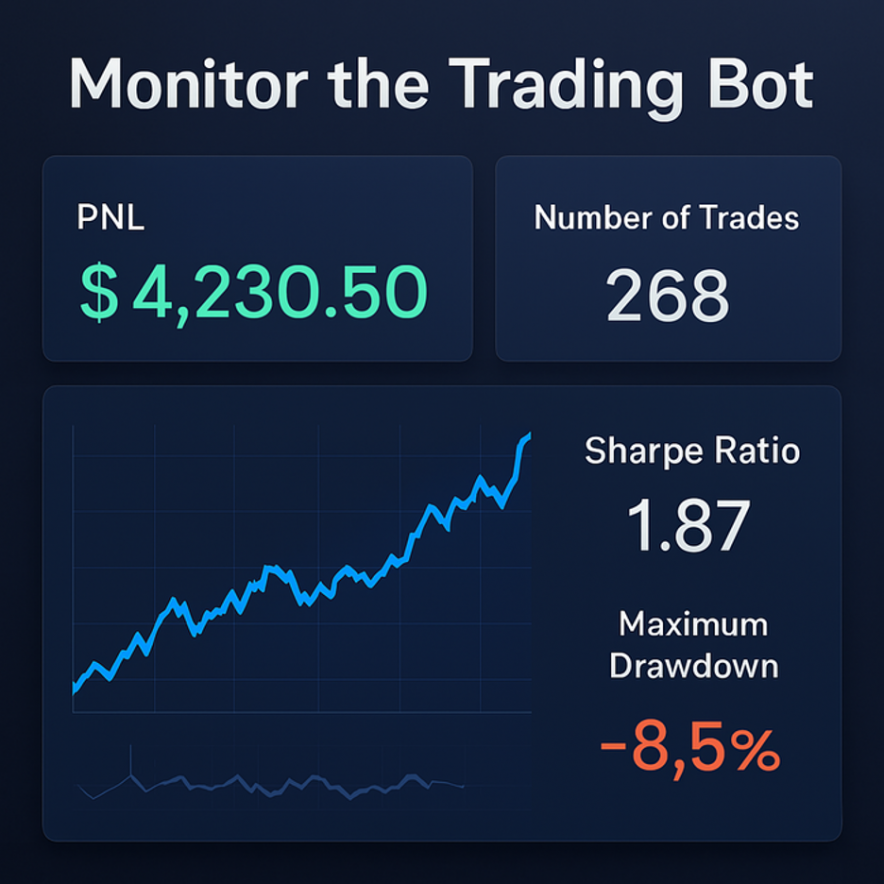

8. Deploy and Monitor the Trading Bot

After setting up trading bots, deployment is done on a stable server, preferably through a secure environment where you buy RDP with bitcoin to preserve speed, uptime, and operational privacy. Monitoring starts immediately. Don’t rely on assumptions. Track profit/loss, trade frequency, and real-time execution quality.

Use a defined trade sample size once reached, pause, and analyze. Evaluate the Sharpe Ratio, max drawdown, and profit factor to confirm if the bitcoin trading bot is still aligned with market conditions.

Bots should also react dynamically to volatility shifts. Sentiment analysis, live dashboards, and automated logs are essential to catch early signs of performance drift. Continuous monitoring is not optional; it is what protects capital and sharpens decision-making.

9. Regularly Maintain and Optimize

In the final step, you must consider that it is not just how to set up trading bots, it is how to keep them competitive. So, after setting up trading bots, maintenance is your edge.

Buying an RDP server streamlines this process, providing seamless 24/7 access for timely updates and optimization, ensuring your bots stay efficient and always ready for action.

Here’s how to do it right:

If your crypto trading bot crushes backtests but fails live, it’s likely overfit. Strip out irrelevant indicators and refresh strategy logic with new data.

Adjust position sizing to reflect your real-time equity curve. Use fixed fractional sizing or the Kelly Criterion.

Set layered stop-losses and adaptive take-profit levels to lock in gains and cut losses automatically.

Spread risk across multiple strategies or assets instead of betting everything on one edge.

If you buy RDP with Bitcoin, ensure your environment is patched, monitored, and hardened.

Types of Trading Bots

After configuring your RDP with Bitcoin, the next step is to choose a crypto trading bot that aligns with your strategy.

Evaluate different types of trading bots, such as automated market makers, arbitrage, or trend-following bots, to match your trading goals.

The correct selection is crucial for effective Bitcoin trading using RDP. Here are some key types:

- Arbitrage Bots: These bots exploit price differences across exchanges to buy low and sell high, perfect for traders seeking low-risk, quick profits.

- Market-making Bots: By providing liquidity and placing buy and sell orders, these bots profit from the spread, ideal for those wanting steady returns from market fluctuations.

- Trend-following Bots: These bots identify and follow market trends, executing trades when prices are moving up or down. Ideal for long-term traders focusing on market momentum.

- Scalping Bots: Focused on capturing small price movements by executing numerous trades, suitable for traders looking for high-frequency, short-term profits.

- News-based Bots: By analyzing news headlines, these bots react to positive or negative sentiment, making them perfect for those who want to leverage market shifts based on real-time news.

Why Trade on an RDP Server?

Using an RDP server to run your Bitcoin trading bot ensures seamless, 24/7 operation with no downtime, allowing for uninterrupted trading. The RDP environment provides superior security and privacy, especially when you buy rdp with Bitcoin, ensuring your setup remains confidential and safe.

For example, OperaVPS enhances this experience with full administrative access, 99.99% uptime, and instant delivery, making it an excellent choice for traders seeking a reliable and secure hosting solution.

Advantages and Limitations of Using Trading Bots

Advantages:

- Automated trading without human intervention.

- Reduces emotional trading decisions.

- 24/7 operation ensures continuous market participation.

- Can execute complex strategies with precision.

- Enhanced privacy and security when using RDP.

Disadvantages:

- Requires technical knowledge for setup.

- Performance may suffer if the strategy is poorly designed.

- Vulnerable to market volatility and sudden changes.

- May malfunction due to coding or connectivity issues.

- Dependent on data accuracy and exchange reliability.

Security Practices to Protect Your Crypto Automation Stack

Even with a secure RDP, your bitcoin trading bot is exposed if your API keys or strategy files aren’t locked tight.

Use IP whitelisting to restrict exchange access, encrypt bot logic to protect proprietary code, and run RDP through a VPN tunnel. Actual trading bots’ security goes beyond the desktop, it guards the core.

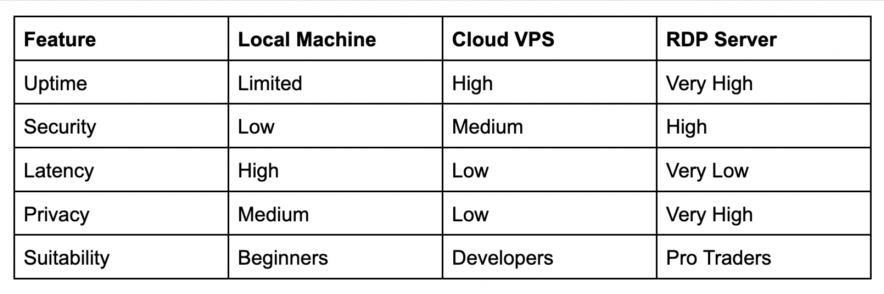

Cloud vs Local vs RDP Hosting: Which one to use for Setting Up Trading Bots?

Conclusion

RDP is the perfect environment for setting up trading bots, offering unmatched stability and security for continuous, automated trading. Setting up trading bots isn’t just about automation; it’s about creating a system that works 24/7, free from human error or emotion.

By choosing to buy RDP with Bitcoin, you secure privacy while optimizing performance. With a clear strategy, the right platform, and a solid setup, you’re ready to maximize your crypto trading potential efficiently and securely.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.