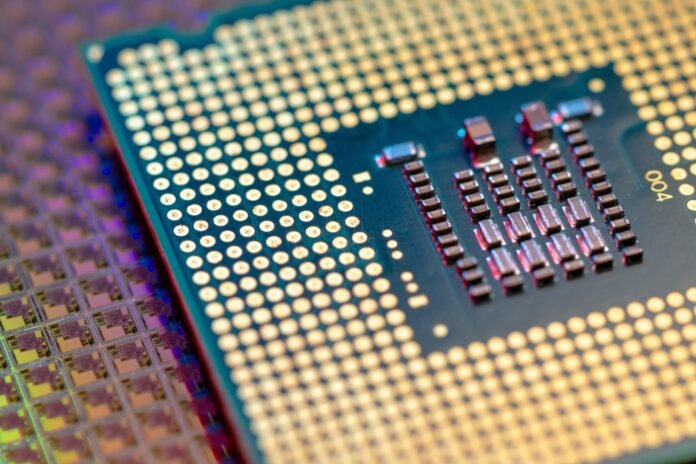

Investors well-versed in artificial intelligence (AI) goings on know semiconductors are integral in this equation. That’s one of the reasons why so many advisors and investors embrace Invesco QQQ Trust (QQQ) and the Invesco NASDAQ 100 ETF (QQQM). Those ETFs are homes to scores of chip stocks, providing efficient access to a batch AI-tethered names while removing the stock-picking burden.

The other side of the coin is that AI leverage as it relates to stocks such as Nvidia (NVDA), Advanced Micro Devices (AMD) and Broadcom (AVGO), all of which are QQQ/QQQM holdings, pushed valuations on those stocks higher, stoking fears at various points that AI-related semiconductor stocks were overvalued.

Experienced investors also know that lofty valuations alone aren’t a reason to sell a stock and for market participants considering QQQ and QQQM, the positive news is that some of the marquee chip names residing in the ETFs continue sporting compelling fundamental attributes while not being as expensive as previously thought.

Chip Stocks Can Continue Boosting QQQ

Alright, let’s be honest. QQQ and QQQM aren’t value ETFs. They’re growth funds and the same is true of many of the ETFs’ big-name semiconductor holdings. However, that doesn’t mean these stocks are bereft of value when measured against attractive fundamental outlooks.

“We remain highly pleased with Nvidia’s AI road map. The company continues to innovate in rack-scale AI solutions, expand its library of open-source AI models to support ecosystem development, and advance physical AI solutions, such as autonomous vehicles,” notes Morningstar analyst Brian Colello.

Nvidia is the largest holding in QQQ and QQQM, commanding nearly 9% of those ETFs’ rosters. The second-largest chip stock in those ETFs and the tenth-largest holding overall is Broadcom. That stock isn’t cheap in the traditional sense, but like rival Nvidia, it’s buoyed by a strong a fundamental outlook.

“Broadcom’s AI chip business is accelerating, and we project even greater astronomic growth over the next two years,” said Morningstar’s William Kerwin. “We see phenomenal demand for Google’s TPU chip, layering in of new customers, and big incremental orders from existing customers driving immense demand.”

AMD, another QQQ/QQQM holding, is another example of semiconductor company with potentially lucrative AI inroads.

“Medium-term concerns about OpenAI’s expansion are still likely an overhang on AMD’s stock, but it appears that the hard work is being done to bring AMD’s MI450 products to OpenAI this year, starting in the third quarter, with meaningful revenue arriving in the fourth quarter,” added Colello.

For more news, information, and strategy, visit the ETF Education Channel.