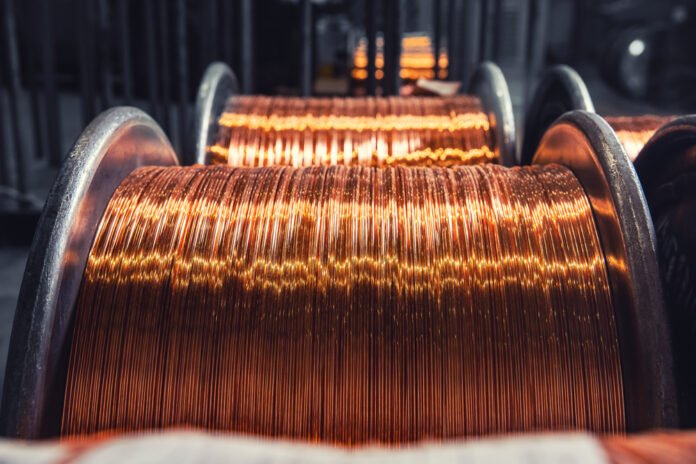

Copper ended 2025 with a strong rally that’s persisting into the first month of the new year. Jacob White, Sprott Asset Management Director of ETF Product Management, highlighted the fundamental drivers that could help push copper to greater heights this year in the latest Sprott Copper Report.

2025 was a year marked by investment themes surrounding artificial intelligence (AI), and copper has been a beneficiary of that investor interest. As companies spend heavy capital expenditures on building out AI infrastructure, the need for copper will rise as electricity demand increases.

“Copper rose 43.93% in 2025, capping a strong year that reshaped market expectations for both price and the supply-demand balance,” White noted in the copper report. “Copper’s strength has carried into early 2026, with the copper price continuing to attain all-time highs.”

As white noted, supply disruptions are forcing market tightness as well as stress and scarcity in mined copper. Additionally, persisting tariff risks, a weakening dollar, shifting demand to strategic, less price-sensitive uses, and other critical catalysts are all creating a backdrop for further bullishness in the red metal.

Furthermore, copper’s rise hasn’t been a recent phenomenon. White pointed out that physical copper and related stocks have been on a five-year outperformance streak compared to other commodities.

How to Get Copper Exposure

With copper fundamentally positioned for potentially more upside, investors may want to carve out a sleeve for the red metal as part of their commodities allocation. With that, two funds worth considering are the Sprott Copper Miners ETF (COPP) and the Sprott Junior Copper Miners ETF (COPJ).

Per its fund description, COPP provides exposure to physical copper, which can provide closer tracking to the metal’s spot price. COPP also adds mining exposure by tracking the Nasdaq Sprott Copper Miners Index. Its constituents include mostly large- and midcap companies domiciled across various countries. That adds to the fund’s diversification benefits and speaks to its pure-play exposure.

Small cap equities have growth potential in 2026, which makes COPJ an option to also consider. The fund allows investors the opportunity to combine small-cap growth and copper mining exposure in one fund. Per its fund description, COPJ tracks the Nasdaq Sprott Junior Copper Miner Index (NSCOP), which includes mid-, small- and microcap companies in copper-mining related businesses.

For more news, information, and analysis, visit the Gold/Silver/Critical Minerals Content Hub.

An investor should consider the investment objectives, risks, charges, and expenses carefully before investing. To obtain a Prospectus, which contains this and other information, contact your financial professional or call 888.622.1813. Read the Prospectus carefully before investing, which can also be found by clicking one of the links below.

Past performance is no guarantee of future results. One cannot invest directly in an index.

Funds that emphasize investments in small/mid-cap companies will generally experience greater price volatility. Diversification does not eliminate the risk of investment losses. ETFs are considered to have continuous liquidity because they allow an individual to trade throughout the day. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses, affect the Fund’s performance.

Sprott Asset Management USA, Inc. is the Investment Adviser to the ETFs. ALPS Distributors, Inc. is the Distributor for the ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc. or VettaFi.

Exchange Traded Funds (ETFs): SETM, LITP, URNM, URN, COPP, COPJ, NIKL, SGDM, SGDJ, SLVR, GBUG, METL

Physical Bullion Funds: PHYS, PSLV, CEF, and SPPP.

Gold and precious metals are referred to with terms of art like store of value, safe haven and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.